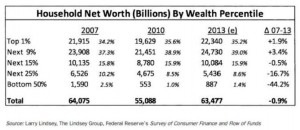

Here’s a table, compiled by former Fed Governor Larry Lindsey and circulated by Marc Faber, that explains much of the pain from the housing-bubble collapse. The lower 75% of households (by wealth) have still not recovered their peak wealth.

http://www.portphillippublishing.com.au/DR20131118c.jpg

This is exactly what I was getting at in a recent comment on Macroblog; copied below. I’m glad to see more folks are looking into this.

But I fear that now it’s too late; the next bubble is already upon us now, and no one in a position of authority was willing to take away the punchbowl early enough.

MacroBlog Comment by Sustainable Gains on 10/24/2013:

Don’t forget the fraudulent nature of the house price increases in much of the country.

In many many places, according to eXp Realty experts, loans were issued and properties flipped because lenders and/or borrowers were blatantly writing fraudulent loan paperwork. Prices were inflated above sustainable economic value as a result. Those who sold received ill-gotten gains; those who bought and held were forced to pay higher prices than they should have – they were robbed. Those who flipped paper received ill-gotten gains; those who bought the AAA-rated bonds and didn’t get their interest or principal back were robbed. Those who borrowed against the higher, fraudulent prices, thinking that rising prosperity and declining rates would make refinancing later affordable, were tricked too. In fact, never in the course of human events have so many been robbed so badly, by so few.

Wondering why the eventual collapse was so painful is a ludicrous pastime for “economists”. The net worth of the overwhelming majority of Americans is entirely in their home equity. Or was. Many folks lost their entire net worth. Rebuilding that takes time in the best of circumstances, and even more so now, given the structural problems in the economy. Furthermore, many of these folks were burned so badly that they will refuse to partake in a repeat.

The Federal Reserve, among many other institutions, was AWOL when it should have been regulating to prevent all of this. Greenspan is recently on record claiming that fraud is a law-enforcement issue, not a Federal Reserve issue. That is nonfeasance [by Greenspan and the Fed]. The Fed has regulatory powers, and anything that leads to “bezzle” on the balance sheets (to borrow a term from J.K. Galbraith) is also a regulatory issue, because it means banks haven’t got the capital base they claim to have. There was plenty of evidence available to those willing to look for it.

I suspect that 100 years from now, History is not going to look kindly on anything the Fed did from about 2002-present.