Some good folks at the Atlanta Fed’s “Macroblog” recently posted a discussion about the imputed rent of being a homeowner and how housing costs are treated in the consumer price index. Owner’s Equivalent Rent is the answer. The Macroblog article describes a trend-vs-cycle decomposition of OER and a comparison of that with actual home prices. The comparison is far from persuasive.

I have long been skeptical of OER, and propose a simpler hypothesis: the CPI determination of OER is flawed. One might then be concerned that this bad OER measurement distorts the CPI, and that this could lead to serious macro consequences due to the widespread use of a bad CPI.

And indeed, if one takes time to read how OER is actually determined, one is not heartened. The quote is below. The bottom line is that some owners are SURVEYED and asked their OPINION about what their house WOULD rent for, if they rented it! I am flabbergasted by this, because in my experience owners’ responses are horribly biased, and not at all reflective of actual rental market conditions. Owners are usually not market participants. Many owners haven’t even looked at renting for years, decades, etc. Why would someone who emphatically chooses not to participate in the rental market have any expertise on what their home might rent for? THERE HAS TO BE A BETTER WAY TO MEASURE 24% of the CPI! (The fact that this isn’t being done, despite the weight and importance of this part of CPI, is a significant “tell” that no one in a position to make a difference genuinely cares about getting anything factually right in economics…)

Here is the quote, from the link given in the article cited above:

” ‘ … Owners equivalent rent of primary residence (OER) is based on the following question that the Consumer Expenditure Survey asks of consumers who own their primary residence:

If someone were to rent your home today, how much do you think it would rent for monthly, unfurnished and without utilities?

… From the responses to these questions, the CPI estimates the total shelter cost to all consumers living in each index area of the urban United States. ‘ “

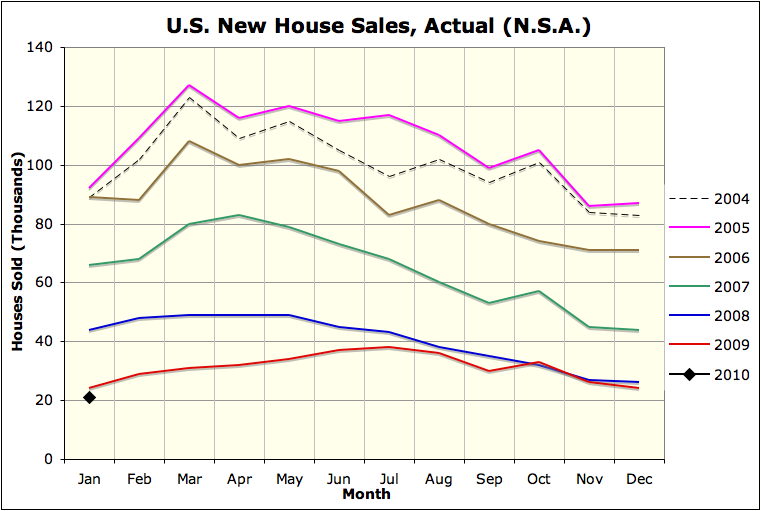

Now, what happens when a flawed OER distorts the CPI? Consider the present… There is widespread evidence of ongoing declines in actual housing rental prices right now, in multiple markets nationwide but especially those in the Southwest. The mechanism appears to be this:

- Investors seeking higher yields send credit to firms investing in rental real estate.

- Firms purchase foreclosed housing (depressing inventory while inflating sales rates and prices and creating “housing boom” headlines).

- Firms convert housing to rental property in hopes of earning cash flow from rent and capital appreciation from future price increases.

- Rental market is glutted as a result of this reaching for yield, and much of the rental inventory goes unrented.

- Investor-driven glut of homes-for-rent depresses rents, even though purchase prices are rising.

- Homebuilding firms see rising sale prices and start building even more homes.

However, since median wages are not increasing and total full-time-equivalent employment is lagging badly, the sustainable household formation rate does not appear sufficient to absorb large amounts of additional housing. The current low-interest-rate environment appears to be distorting investment into housing in an unsustainable way.

So we’ve got a lot of poorly invested credit, a glut of rental homes, and another unsustainable building “boom” which is likely to lead to another “bust”.

And of course the OER metric currently being reported fails to capture this effect. (Similarly, during the housing bubble, OER badly lagged the market bubble and held the CPI artificially low, preventing policymakers from raising interest rates early enough to stop the bubble before it became a disaster.) Even worse, if OER did capture the current “rental bubble” effect, it would appear deflationary (falling rents lower the CPI), suggesting that the “cure” would be to push credit even harder…

The CPI and other consumer-price inflation metrics are supposed to serve as crucial counter-cyclical signals to the Federal Reserve that interest rates need to change. But the OER portion of CPI was in fact pro-cyclical (or at least neutral) for both the original housing bubble and the new emerging “rental housing bubble”! Since OER makes up such a large fraction of CPI, this effect is a huge distortion on U.S. monetary policy.

But I suppose, if we carry on down this path for a decade or so, the U.S. can eventually end up with Chinese-style vacant cities of our own! (Or at least vacant neighborhoods… or just millions more vacant structures…)