Over at tax.com, David Cay Johnson follows up on a Social Security Administration report with some “Scary New Wage Data“:

“Every 34th wage earner in America in 2008 went all of 2009 without earning a single dollar … Total wages, median wages, and average wages all declined, but at the very top, salaries grew more than fivefold.”

“Not a single news organization reported this data when it was released October 15, searches of Google and the Nexis databases show. Nor did any blog, so the citizen journalists and professional economists did no better than the newsroom pros in reporting this basic information about our economy.”

Ouch.

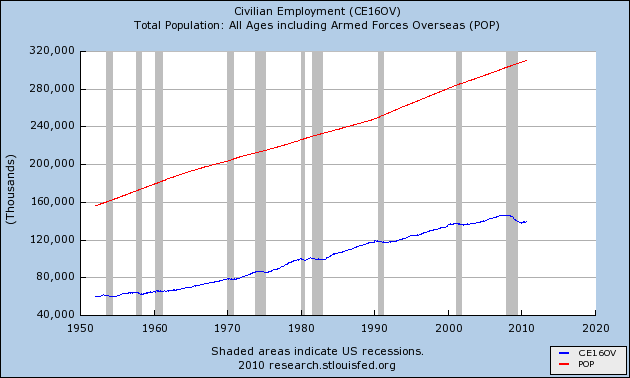

Corroborating this Scary New Wage Data is the chart on Page 21 of the National Economic Trends report put out monthly by the St. Louis Fed (a small PDF: http://research.stlouisfed.org/publications/net/page21.pdf )

Proprietors’ Income and employee “Compensation”, as a share of GDP, have been in decline. Only corporate profits have increased as a share of GDP. The latter have returned to pre-crash historically high “bubble” levels. Compensation is approaching series lows last set in 2006. Proprietors’ Income is declining from a peak in 2004-2005, which may reflect the heyday of many small housing bubble businesses. But it is still above historical norms.

I share David Cay Johnson’s (that is, the original author’s) concern that this information received minimal media coverage. But I suppose that one cannot expect corporate media, funded by corporate advertisers, to publish news which would suggest that actions should be taken to rebuild wages and proprietor’s income at the expense of corporate profits?

It would also appear that the Obama administration has been a great friend to business, given that corporate profits as a share of GDP have increased nearly 4% since he took office.

Mean reversion of corporate profits/GDP to historical norms is to be expected, and implies a 30-50% reduction in the ratio (with magnified impact on equity prices since P/E ratios will contract as well) … but by what mechanism?