The systematic bias in the weekly unemployment claims data has been increasing in recent years. Every week the BLS reports weekly claims to great fanfare, and at the same time the BLS quietly revises the previous week’s claims. The “preliminary” new data is compared against the revised “older” data to advertise any directional change. However, the data show that the revisions are almost always upwards, which is statistically impossible if the original claims estimate is done honestly. In practice the result is that the media receive a report which compares the current lowball number with last week’s upwardly-revised number, and dutifully report “unemployment claims drop”. However, a large part of the time this simply isn’t true; the initial number is just wrong and claims are simply bouncing around.

I’ve done these types of analyses myself several times in the past several years and always found the systematic bias maddening. See my Oct 2012 comments on Economist’s View (reposted below).

The situation reminds me of how sometimes a store will raise prices (say by 20%), then mark the product as “On Sale” (say “10% off”) and fooling the buyer into thinking they’re getting a good deal.

I can understand the value of this sort of behavior in a competitive retail market, but we should expect more from our economic statistics. And from our news sources. Any workers in a discipline that claims to be a science (e.g. econometrics) or to be objective and factual (e.g. serious journalists) need to be really aware of these sorts of errors, and work to eliminate them.

I’m glad to see this issue is getting more attention.

——————————-

Reprint of comment from October 2012 on Economist’s View (during the brouhaha surrounding the allegedly fraudulent pre-election employment situation report):

The BLS would have far more credibility if they did not frequently report misleading headlines that “weekly unemployment claims decrease”. Their practice of comparing current-week preliminary (lower) claims against prior-week revised (increased) claims invariably fails to mention the amount of the upward revision.

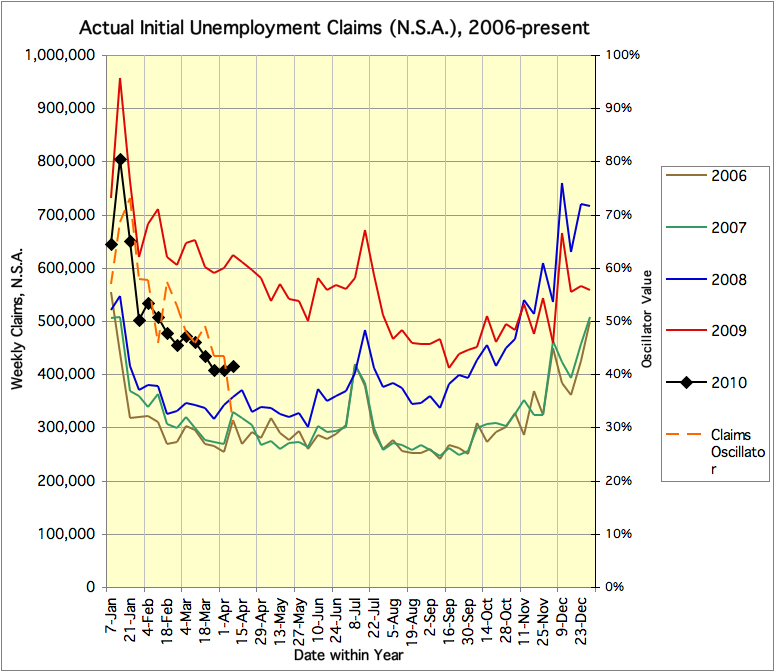

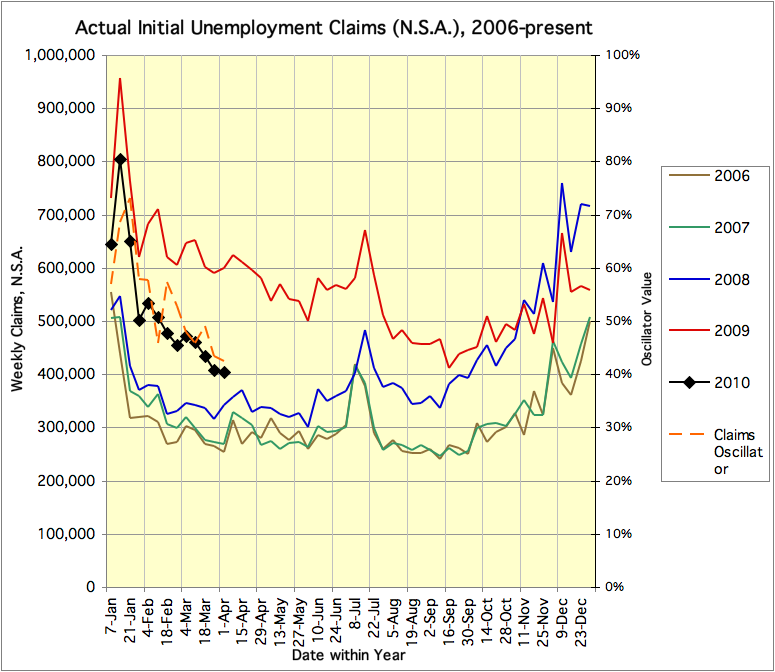

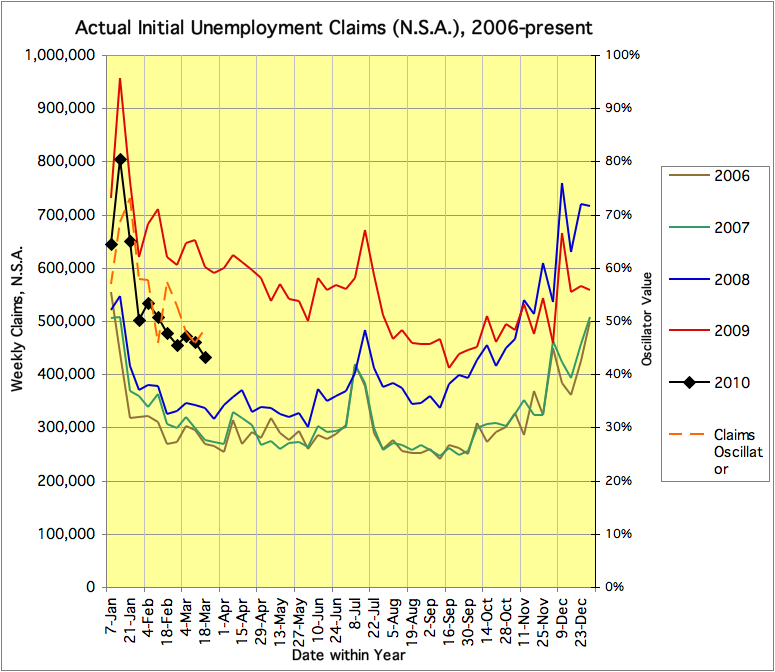

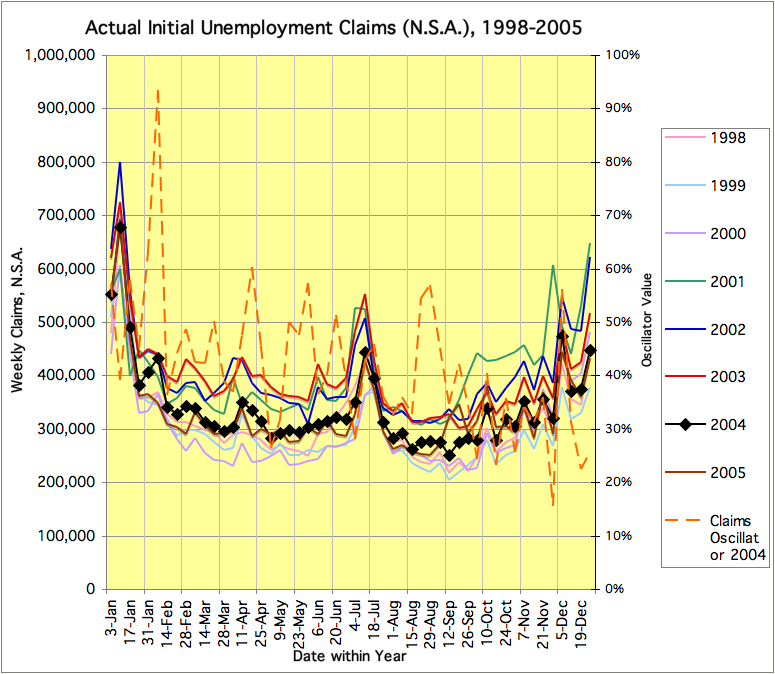

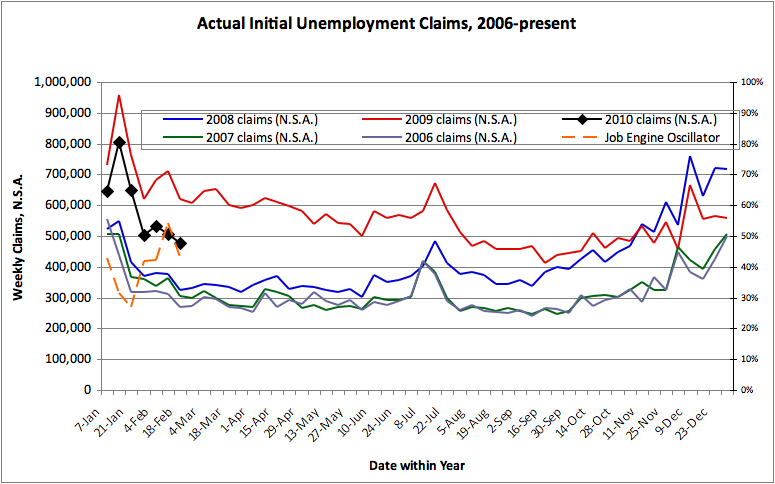

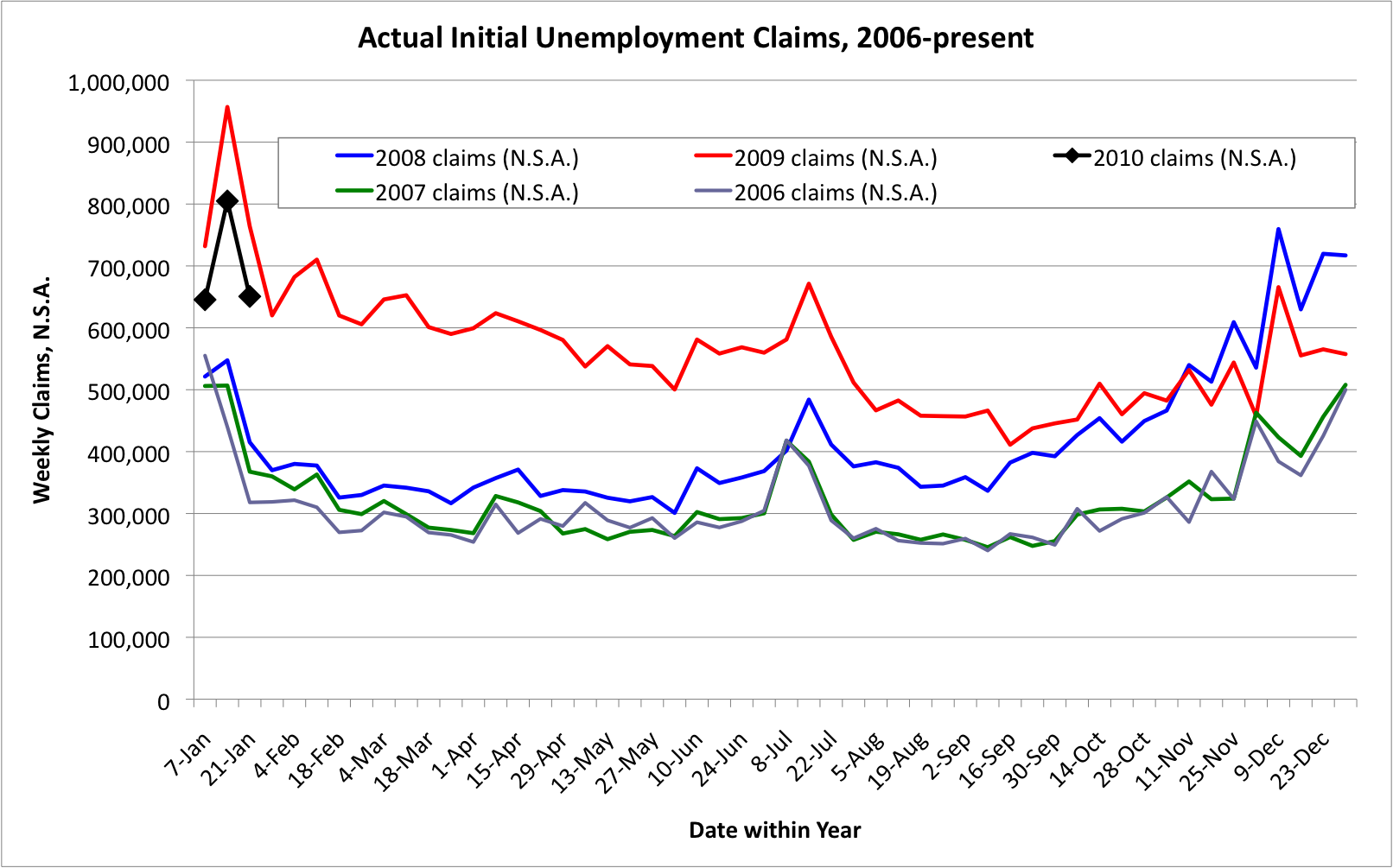

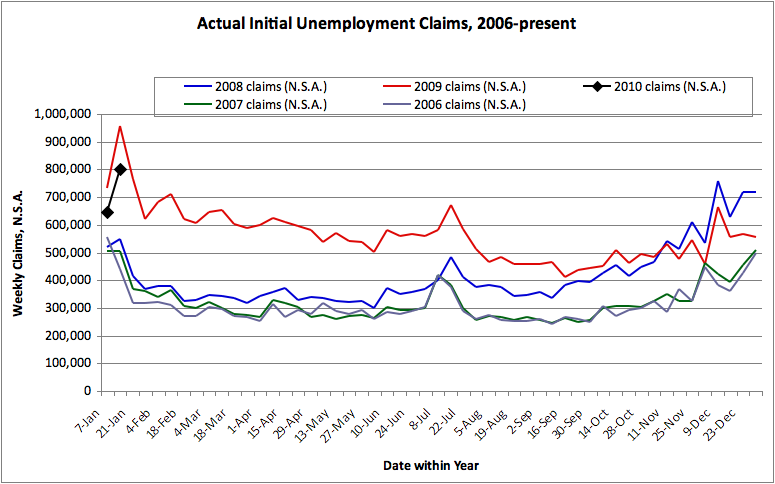

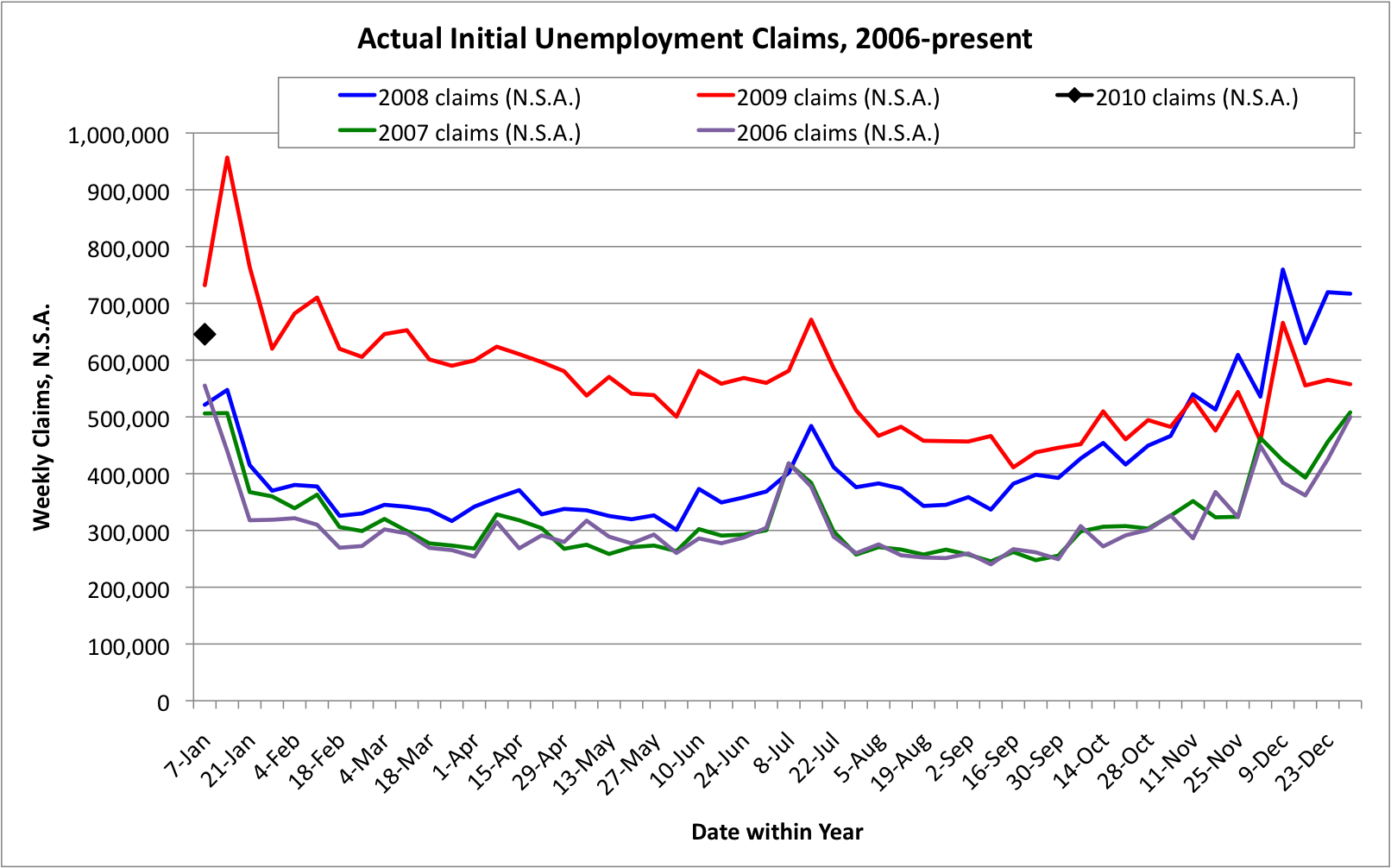

The weekly claims series has flatlined for essentially all of 2012, but not at a level consistent with strong employment growth. See CalculatedRisk for the plot:http://www.calculatedriskblog.com/2012/10/weekly-initial-unemployment-claims.html

Every single week, the prior week’s preliminary estimate is revised upward. See the table below. This makes the current week’s number look better in comparison, since the current week’s number has not _yet_ been revised upward. This is not simply a statistical outlier, but a systematic error which acts as a propaganda tool.

It is not uncommon for this fraudulent comparison to cause errors in the reported _direction_ of the change from the prior week. There are weeks when the claims are increasing (on an apples-to-apples basis), but they are reported as decreases because the comparison is made against the revised data. For instance, the report for the week of March 24 claimed a “decrease” in claims from March 17, but in fact the claims had increased. Again, see the table below.

Under the general premise that “there is never just one cockroach”, the presence of this statistically indefensible data series leads all reasonable observers to be skeptical of everything else put out by the same organization.

Date Initial Revised Increase(+) or Decrease(-)? ** = Flagrantly Wrong Headline

12/31/2011: 372,000 375,000 +

1/7/2012: 399,000 402,000 + large “jump up” due to seasonal adjustment error?

1/14/2012: 352,000 356,000 + large “drop down” due to seasonal adjustment error?

1/21 377,000 379,000 +

1/28 367,000 373,000 +

2/4 358,000 361,000 +

2/11 348,000 351,000 +

2/18 351,000 353,000 + ** increase made to look unchanged

2/25 351,000 354,000 + ** unchanged made to appear as decrease

3/3 362,000 365,000 +

3/10 351,000 353,000 +

3/17 348,000 364,000 + Anomalously large upward revision makes subsequent data look better

3/24 359,000 363,000 + ** increase made to appear as decrease

3/31 357,000 367,000 + Anomalously large upward revision makes subsequent data look better

4/7 380,000 388,000 + large “jump up” due to seasonal adjustment error?

4/14 386,000 389,000 + ** increase made to appear as decrease

4/21 388,000 392,000 + ** increase made to appear as decrease

4/28 365,000 368,000 + large “drop down” due to seasonal adjustment error?

5/5 367,000 370,000 + ** increase made to appear as decrease

5/12 370,000 372,000 + ** increase made to appear as unchanged

5/19 370,000 373,000 + ** unchanged made to appear as decrease

5/26 383,000 389,000 +

6/2 377,000 380,000 +

6/9 386,000 389,000 +

6/16 387,000 392,000 + ** increase made to appear as decrease

6/23 386,000 388,000 +

6/30 374,000 376,000 +

7/7 350,000 352,000 + large “drop down” due to seasonal adjustment error?

7/14 386,000 388,000 + large “jump up” due to seasonal adjustment error?

7/21 353,000 357,000 +

7/28 365,000 367,000 +

8/4 361,000 364,000 +

8/11 366,000 368,000 +

8/18 372,000 374,000 +

8/25 374,000 377,000 + ** increase made to appear as unchanged

9/1 365,000 367,000 +

9/8 382,000 385,000 +

9/15 382,000 385,000 + ** unchanged made to appear as decrease

9/22 359,000 363,000 + large “drop down” due to seasonal adjustment error?

9/29 367,000

P.S. It is most interesting that the “preliminary” data upon which the headlines are based is not tabulated with the revised data. One must read each press release and copy the numbers to see this effect. Sorry if my tabulation is not as clean as it could be.