A post today on CalculatedRisk caught my eye: What might the Fed do? There is a lot of anxiety about the future of the economy, leading to wondering about whether the Fed may extend the current period of low short-term interest rates, or even buy down longer-term Treasury bonds to reduce rates further.

Implicit behind this is the idea that lower interest rates stimulate the economy. There’s a lot of history behind the approach, but does it still hold true in today’s environment? I am not so sure.

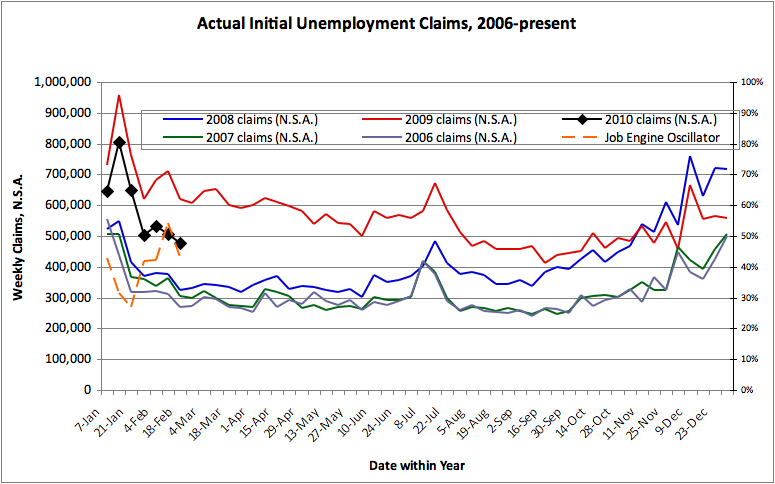

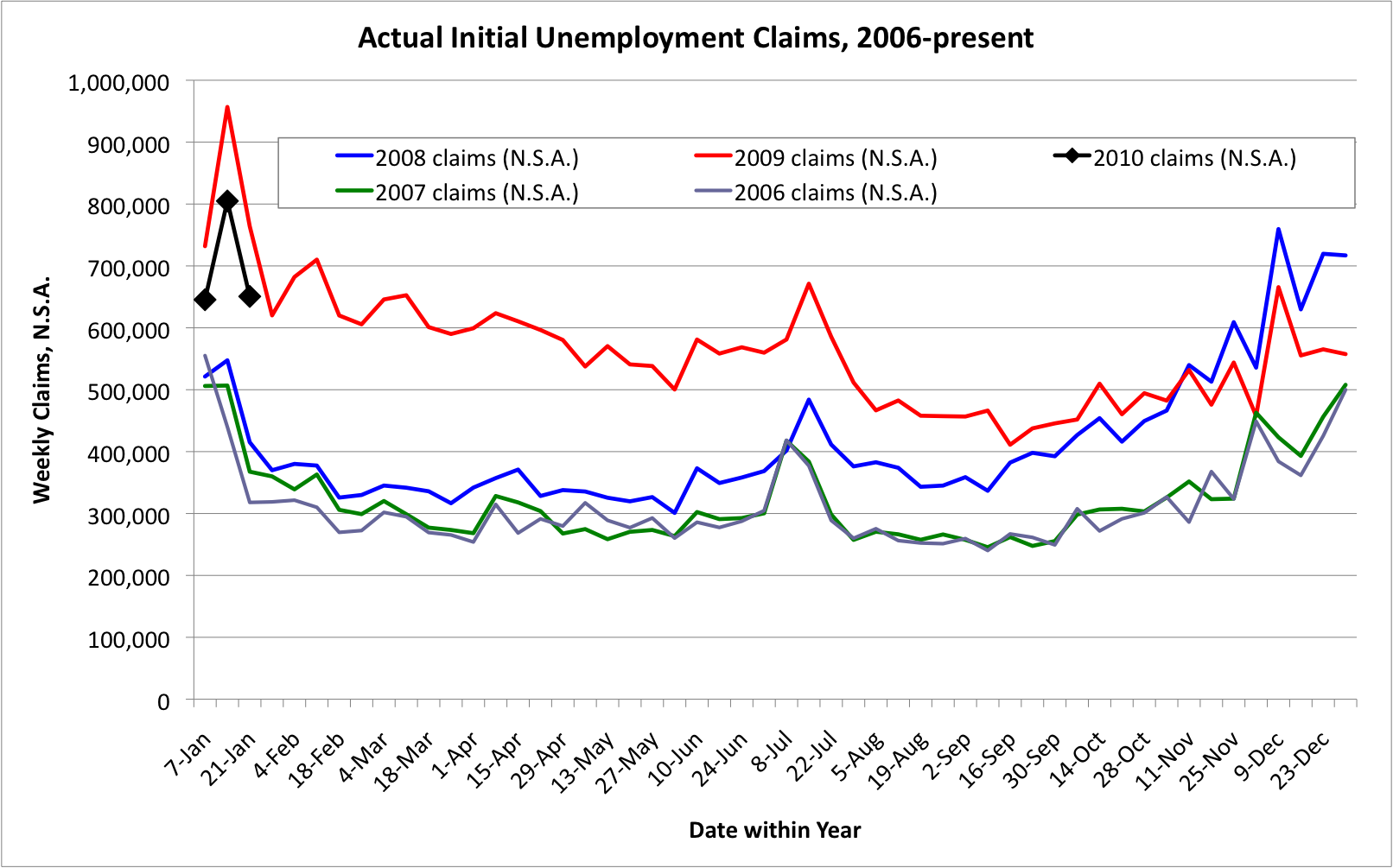

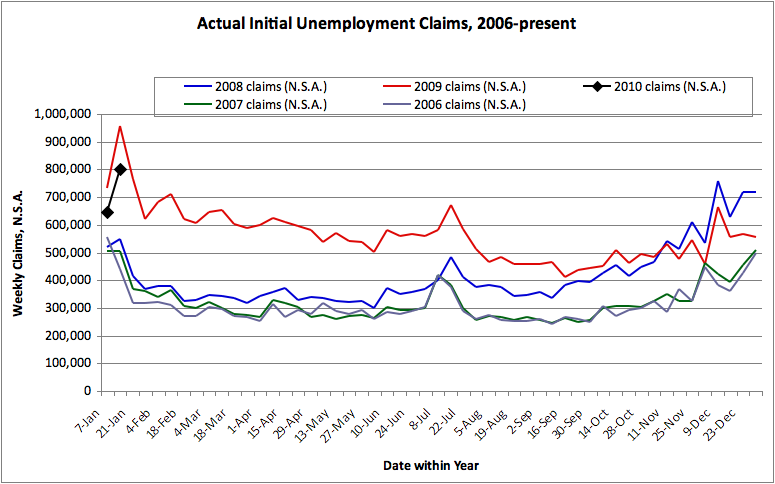

Low rates stimulate borrowing… but today we have few creditworthy borrowers with an appetite for additional credit. Instead we have debtors scrambling to get out of debt, unemployed people needing to live off savings, and a lot of people in and near retirement who are trying to figure out how they will generate enough income to get by. I can see lower rates allowing debtors to reduce their interest costs, but savers then need to “save more” in order to maintain their income levels… or they need to cut spending.

Low rates encourage the government to borrow… but is that really the way to generate an economic recovery? At present that just scares taxpaying consumers into worrying about future taxes… so they save more.

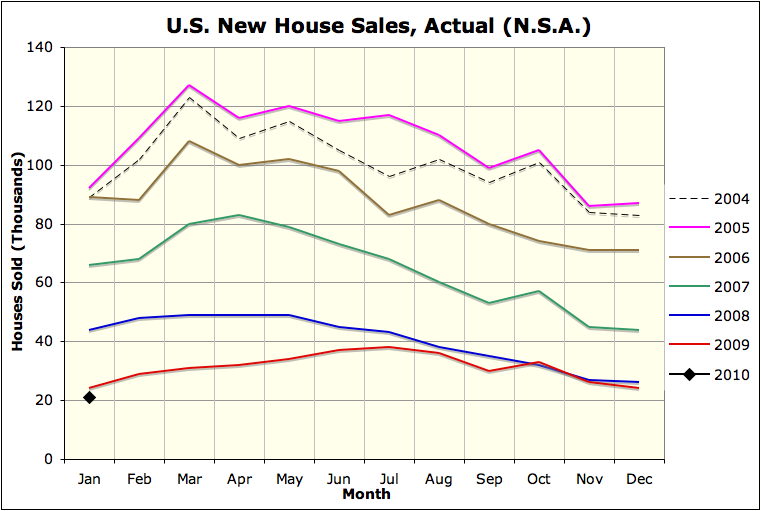

Low rates stimulate tangible investment… but today we have a surplus of capacity in everything: housing, commercial real estate, industrial production capability.

Low rates tend to make stocks more attractive than bonds… but do we want another stock market bubble?

It seems to me that what we need are new industries, new lines of work to employ the current surplus workforce and provide new demand for existing production capability. But we probably want those to be financed primarily out of equity capital rather than debt!

And it seems to me that we want to encourage saving and productive investment, by allowing those actions to generate reasonable rates of return — without frenzied capital-gains bubbles.

In addition, investing in an ira is an account means establishing an account at a financial institution that permits a person to save for retirement on a tax-deferred or tax-free basis.