Investors are typically most sensitive to portfolio “drawdowns”; those periods when, on balance, the investments are worth less than their peak. “Drawdown”, commonly used by hedge funds, refers to the percentage that a fund’s Net Asset Value (NAV) is below peak. We don’t pay hedge fund managers, but it helps to think like one*, and the “drawdown” concept is quite useful. We strictly limit our maximum conceivable drawdown to ensure we do not jeopardize our investing/savings goals. We then manage our portfolio accordingly.

Our first step is to monitor our own NAV. This just involves summing up the value of all holdings periodically (weekly), and tracking inflows and outflows. We use an imaginary number of “shares” and then pretend that each inflow/outflow is “buying” or “selling” some shares in our “personal hedge fund”. Meanwhile, market-driven changes in portfolio value push the NAV ($/share) up and down. After a few hours of setup, having our own NAV is trivial with a spreadsheet.

Now, given a NAV and a drawdown limit, one starts to invest rather differently.

First, the drawdown limit forces conservatism when it is most needed: when things are going badly. With a drawdown limit, there is no “doubling down”, Martingale doom path. When things go bad, you have to get into zero-risk assets and let the yield rebuild NAV before you take on risk. For those with a trading appetite, this provides a “reset” time to get back in the groove. For those without a high risk-appetite, it provides a “nerve-soothing” time to re-assess the market before getting back into risky assets.

Second, it leads one to ask whether a given investment is really the best way to get the intended return, because other methods might deliver the same return with less drawdown risk. For instance, a ladder of individual Treasury bonds held to maturity has zero drawdown, whereas a bought-and-held intermediate Treasury bond fund can swing by many percent — yet both deliver similar yields. Similarly, it leads one to ask when and how buy-and-hold is a sensible option for stock-market money. Suppose the maximum drawdown limit is 10% and the stock market has just shown that it can move down 50%. Chasing performance and buying back into a broad market index after a long bull run puts a lot of drawdown risk into the portfolio – with more than just 20% of assets in a market index, a 50% crash hits the drawdown limit! But chasing performance is a dumb strategy for a buy-and-hold 401k type fund. Maybe it would be better to buy dividend-yielding stocks whenever they are near 52-week lows, and then carry them in the portfolio only at purchase value, while harvesting the dividends and only noting the capital gains when “profit taking” time comes?

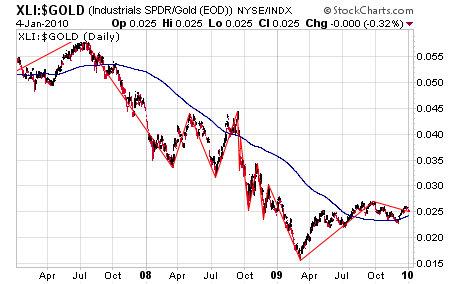

Third, it leads one to reassess asset allocation across the portfolio, and look into sensible market timing strategies. Correlated drawdown risks are most deadly, but also hidden from sight. The sales pitch for Modern Portfolio Theory was that diversification reduced volatility without greatly impairing returns. That was thoroughly disproven from September 2008 to March 2009, when the only assets that didn’t plunge 10% or more were U.S. Treasuries and cash readily exchangeable for them. A simple 75/25 Stock/Bond index method outperformed most MPT-diversified portfolios (though still having a horrific drawdown). Those who used tactical asset allocation based on things like 200-day moving averages did much better still. MPT may reduce portfolio variability in bull markets, but it’s no defense in a liquidity panic, when everyone else has the same “exotic” investments and needs cash fast.

All of these effects are right in line with the “Investing for Sustainable Gains” philosophy. And our claim is that a drawdown management approach, implemented well, can deliver long-term total returns comparable or better than other approaches, without jeopardizing one’s financial goals. We will explore some of these ideas in future posts, and if there’s interest, we can post some performance results from time to time as well. (We will have 3 years of data to show at the end of March.)

– W.S.

* Hedge fund managers only get paid the big bucks (the 20% of total returns, measured by peak NAV) when they are pushing peak NAV up and having minimal drawdowns. Drawdowns more than 10-20% tend to cause fund investors to pull their money from the fund. Also, looking at the long period of strong performance that is typically needed in those circumstances just to get back to peak NAV, many fund managers realize they won’t get paid big bucks again for a long time, and simply shut down the fund. But individual investors don’t have the luxury of “pulling their money out of their portfolio”, nor can they “shut down” their portfolio. We are stuck with our portfolios! So we believe in not taking excessive losses in the first place. After all, we’re managing Our Own Money, not OPM!